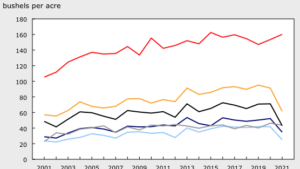

El Niño Impacts Agricultural Production

Sowing of the summer cereal crops begins in March, with harvesting activities normally commencing in October. Northern parts of the United States, including the Corn Belt in the Midwest, have tended to receive below-average rains during the first six months of the year during an El Niño episode. However, the impact on rainfall variations tend to weaken in the second half of the calendar year. Below-average rains early in the cropping season might negatively impact crop growth, but a more limited impact would be expected as the season progresses.

Trade Tantrum

Among the TPP member countries, tariffs on agricultural goods are wide-ranging. For example, Japan maintains average applied tariffs of 23 per cent on agricultural goods, while Malaysia applies tariffs of 11 per cent and Vietnam at 17 per cent. Canada’s agriculture and agri-food exports to TPP members include oilseeds and oils (such as canola), pork, beef, grains, pulses, fruits and vegetables, maple syrup and processed agricultural products. The chances of TPP reaching an agreement look 50:50, Ritz said.

Canada’s Drone advantage

“We produce a system that allows people to get data — valuable data,” explains Ernie Earon of PrecisionHawk. The company’s fixed wing drone flies autonomously, snapping photos over planted fields. When the images are analyzed, light green patches on the picture indicate stress points on the crop. Previously, a farmer would have had to walk the whole crop to find these problem areas — a task that could take hours. PrecisionHawk is working on cameras, which can ‘see’ to a plant’s sub-cellular level. That will allow farmers to detect disease in a plant before it shows any visible sign and to determine which areas need more or less fertilizer. Canada’s drone makers stand to benefit from the fast-growing industry, but they’ll face increasing competition. Sophisticated drone production has been largely limited to Europe and North America, but Asia is making up for lost time — led by China, which is focusing largely on military uses.

Competition Spurs Research

In June, Genome Canada, in partnership with the Western Grains Research Foundation (WGRF), are requesting applications for the 2014 Large-Scale Applied Research Project Competition: Genomics and Feeding the Future. The competition supports research projects that will create new knowledge and inform public policy for Canada’s agri-food and fisheries and aquaculture sectors and contribute solutions that can help feed the world’s growing population.

Approximately $90 million will be invested during a four-year period in large-scale research projects across Canada, each ranging from $2 million to $10 million. Genome Canada will invest $30 million, WGRF $5 million, and the balance of investment will be obtained through co-funding of projects from other sources, such as industry, governments and not-for-profits. Projects will be selected through a rigorous international peer review process. “Genomics and genomic-related technologies in the agri-food and fisheries and aquaculture sectors can play a strong role in boosting food production and international trade, raising nutritional value, reducing spoilage and ensuring food safety both in Canada and globally,” says Pierre Meulien, president and CEO of Genome Canada.

Report forecasts global biotech trends

The global agricultural biotechnology market is consolidating as the top three seed manufacturing companies accounted for nearly 48 per cent of the market in 2012, according to Research and Markets’ new report, “Agricultural Biotechnology Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013-2019.” The report states that large players are acquiring small regional players or collaborating with research institutes or large crop growers to expand their market share and gain a competitive advantage by increasing their presence across the value chain. Major players in the market, according to Research and Markets’ report, include Monsanto, DuPont, Syngenta, Bayer CropScience, Dow AgroSciences, Vilmorin, Certis USA, Evogene Ltd. and KWS SAAT AG, among others. The report also confirms that soybeans and corn are the most widely consumed genetically modified crops globally. Rising demand for animal feed due to increasing consumption of meat is expected to drive the market for these crops. The global agri-biotech market was dominated by North American countries because of high adoption of GM crops and acceptance by consumers. Additionally, the report reveals that biotech companies are spending 15 to 20 per cent of revenues on research and development initiatives. Brazil is forecast to be the next growth engine of agri-biotech after the United States.