Practical and pretty, seed coatings and colourants play an important role in the ability to deliver farmers complete seed solutions.

We’ve all seen the statistics on population growth. The unofficial challenge has been issued to the agriculture industry, and more specifically the seed sector, to find a way to help farmers produce more with less. But there is ‘fine print’ that comes with this challenge, and it reads that we must do it in a responsible and sustainable manner.

Looking at the crop protection industry as a whole, great strides have been made in R&D over the last two decades to create products that are both safer for users and the environment. When we examine how this has been accomplished we’ll note there has been a shift in the delivery method of insecticides, fertilisers and fungicide products. We apply less by foliar application and increasingly these products are delivered with the seed.

To ensure that farmers are equipped to succeed, the seed and crop protection sectors have been actively working together, finding ways to create a total seed package that safely and effectively delivers the necessary seed enhancement products. Marc Andrieux, head of SeedGrowth Technology & Services at Bayer CropScience perhaps sums it up best: “The idea in the end is that you [the farmer] can simply plant your seed and everything will be there and grow well.”

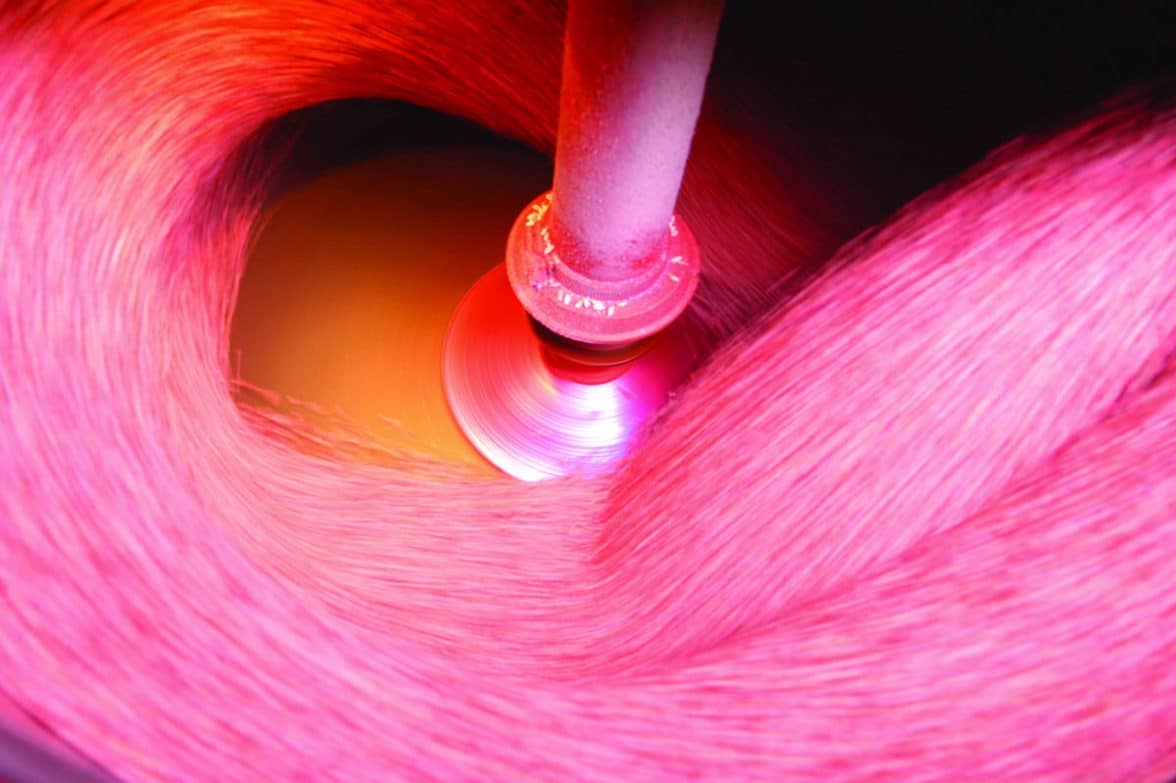

Enter the important role of seed coatings.

The Role of Coatings

“Breeding companies invest a lot of money and resources to bring the best genetic material to the market, and their seeds require a protective seed treatment product to control several pests,” says Willem Fijma, business area manager with Incotec Field Crops Europe. “Polymer coatings offer the ability to stick these seed treatment products to the seeds, controlling dust-off and thus reducing losses of active matter.”

“A coating can act as vehicle for several compounds, enhancing the early emergence of the germinating seeds. In addition to seed-applied fungicides and insecticides, product like growth promoters, bio-stimulants and trace elements can be added using specially formulated seed coatings. Basically, the role of the seed coatings is to adhere these beneficial formulations in the ‘seed space’,” Fijma explains.

But that’s not where the role of seed coatings ends. Both Fijma and Andrieux emphasise the importance of seed coatings to ensure proper flowability during planting, improve seeding rates and prevent doubles or skips. “Seeds which are difficult to drill because of size and shape can be coated with multiple layers of bulking material to create a uniformly-sized seed, resulting in uniform plant establishment,” Fijma says.

Dealing with Dust

With increasing pressure facing the industry, seed coatings also play a key role in product stewardship. Andrieux confirms this: “Dust always accompanies treated seeds. One example of how stewardship is practiced at Bayer SeedGrowth comes from the company’s successful efforts to limit dust-off through improved formulation, through tailor-made film coatings and their improved use by our customers.”

“We want to keep all the product on the seed,” says Andrieux. “Seed coatings themselves are designed to be neutral, they need to be compatible with the other products applied to the seed. In the end, we want the final product to be safe for the seed, safe for the operator and safe for the environment.”

Innovation and Adaptability

Companies involved in the seed coating industry are actively investing in R&D. With a dedicated facility and team based at Méréville, France, Bayer SeedGrowth Coatings develops new and innovative seed-applied technologies. As part of their work they tackle the challenges of germination, sowability, flowability and dust control testing applications in both the lab and on the field.

“Bayer SeedGrowth plans to launch ten of fifteen new film coating products launched over the next five years,” says Andrieux. “When we develop new products we try to consider the needs of the global market.” Bayer’s new solutions include products targeted for small grains, corn, rice and soybean.

According to Fijma, one of Incotec’s key areas of investment is the development of seed-applied additives. “We do believe this has a great future and we will bring these special coatings to market. One of our seed-applied additive concepts is Genius Coat, a ready-to-use seed coating that stimulates root formation and crop establishment. Coatings can add more value to the genetic potential of a variety.”

Fijma states that we can also expect to see more ‘intelligent polymers’ from Incotec’s pipeline — things such as coatings that regulate the speed of growth of parental lines, nanotechnology, coatings that regulate the release of active matter in the soil, or ID polymers to identify specific varieties or seed treatments, all of which will add new value to the range of base coatings that are marketed today.

What’s Next?

The global seed coating materials market is growing at a healthy rate and the market is expected to grow in the future, according to a recently released report titled Seed Coating Materials Market by Type (Polymers, Colorants, Binders, and Other Additives), By Crop Type (Cereals & Grains, Oilseeds, Fruits & Vegetables) & By Geography – Global Trends & Forecasts to 2019 from U.S.-based market research and consulting firm Markets and Markets. The report projects the seed coating materials market to reach USD $1,426.78 million by 2019, with a compound annual growth rate of 7.5 per cent from 2014 to 2019. They cite market demand for progressive multifunctional seed technologies to avert the decreasing acreage and to increase seed performance is one of the driving factors of market growth.

The report also speaks to the potential of this market and that it is attracting leading companies to invest. Companies are focusing on global expansion and setting up new plants for increasing production capacity as well as strengthening their product lines. Markets and Markets notes that these companies are also putting efforts into developing innovative new products, which are eco-friendly, to overcome the regulatory restraints.

“Seed coating and seed enhancement technology is becoming increasingly complex and requires increasingly larger investments in research, production facilities and know-how. To develop and produce the many different product combinations necessary to meet the demand of growers around the world, and to do so while ensuring profitability, you need to reach a certain scale of operation,” says Fijma. He predicts that in the future, the industry will become more specialised with seed companies choosing to stay focused on genetics versus seed enhancements.

“We need to produce more food with less agricultural area and this will increase the demand for better genetics, seed treatments and top-quality seed coating technology,” Fijma explains. “Farmers will have a stronger influence on the treatments and genetics they will grow. Incotec is certainly willing to support them downstream by providing state-of-the-art seed applied products.”

Market Snapshot: Seed Coatings

- The seed coating materials market is estimated to be worth USD $993.84 million in 2014 and is projected to reach USD $1 426.78 mn by 2019

- Polymers are the major contributors towards performance enhancement of coating materials. They also dominated the seed coating materials market followed by colourants and binders in 2014

- The cereals and grains segment held the largest market share for seed coating materials followed by the oilseeds segment

- North America and Europe are the top two consumers of seed coating materials and accounted for more than 55 per cent of the market in 2013

- The Asia-Pacific region is estimated to be the fastest-growing region in terms of value

- Growth is particularly high in emerging countries, such as China, India, and Brazil because of the major contribution of agriculture in the economy and the increase in demand for agriculture production

Source: Markets and Markets: Seed Coating Materials Market by Type (Polymers, Colorants, Binders, and Other Additives),B Crop Type (Cereals & Grains, Oilseeds, Fruits & Vegetables) & By Geography – Global Trends & Forecasts to 2019